From Catamarca to Qinghai: The Commercial Scale Direct Lithium Extraction Operations

Alex Grant, Principal, Jade Cove Partners, San Francisco, USA

April 2020

The PDF of this article is available here and its associated LinkedIn post is available here.

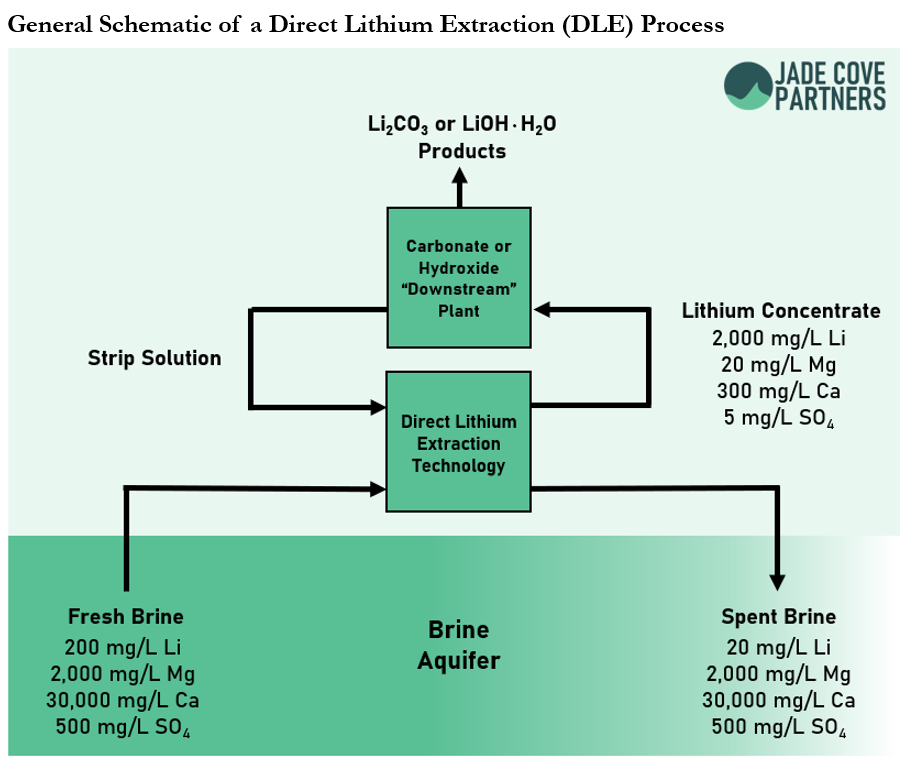

The majority of lithium extracted from brine resources currently passes through an evaporation pond before it is converted into chemicals like lithium carbonate, and lithium carbonate to lithium hydroxide, which are used to manufacture batteries. The evaporation ponds of the Salar de Atacama in Northern Chile have recently received attention for their perceived impacts on water resources. Some stakeholders believe that direct lithium extraction (DLE) is a more preferred, even ethical, way to produce lithium from these brines. DLE technologies use physical or chemical selective processes to remove lithium from brines while leaving other components in the brine.

The water impact intrigue of the Atacama has drawn a community of technologists to the lithium industry in the last 10 years, looking to “solve the problem” of evaporation ponds. They are proposing a variety of different kinds of DLE technologies including solvent extraction, ion exchange, membranes, adsorption, and electrochemical processes. They all propose that their technologies will obviate the need for evaporation of the water from the brine, and other more commercial benefits that are favorable for production of lithium chemicals for the 21st Century battery industry. As of Q1 2020, Jade Cove is tracking 45 different DLE technology solutions which may be incorporated into new lithium brine projects in development, whether at the Atacama in Chile, or in any other expansion or greenfield project.

Just over the border in Argentina, lithium has been extracted using DLE at commercial scale for decades, but somehow not very many people know this. It is a shocking revelation to some that DLE is actually already commercial, and proven to operate economically by a major lithium producer. This article presents an overview of five DLE projects currently constructed at commercial scale: one mature, and four recently commissioned. The fact that these projects already exist and produce meaningful quantities of lithium chemicals demonstrates that DLE technologies are not mysterious “black boxes” that investors won’t ever be able to understand, but instead operate using physical and chemical principles consistent with the laws of physics, and which some people already do understand quite well. The projects described in this article are responsible for producing ~12% of 2019 lithium supply using DLE.

One of these projects is Livent’s main source of lithium in Argentina. This project now has a long history of stable operation and production of high-quality lithium chemicals. Livent is planning on expanding this operation to produce more lithium chemicals from their brine resource using DLE. They also have a development agreement with E3 Metals to cooperate on development of a DLE technology for E3’s oilfield brine resource in Alberta, Canada. For various reasons, Livent has not pursued Australian spodumene resource development like other major lithium companies. Livent’s relationship with E3 Metals may have us wonder if they may continue to exclusively develop DLE projects instead of expanding into other types of lithium resources.

All of the DLE projects built since lithium demand started to increase rapidly in the 2010s have been brownfield projects, built to extract lithium from waste brines of evaporative brine facilities in Qinghai, China. These brines contain high concentrations of Mg and SO4: two components that Atacama-style evaporative processes for lithium extraction do not handle well. Some of these brines have Mg/Li ratios into the 100s (see below), (1) and yet some developers are successfully implementing DLE technologies to produce lithium from them.

In the last decade or so, a significant amount of experimentation has occurred across the entire Qinghai lithium brinefield. All different types of DLE have been tested by different groups, and much more exotic processes have been considered. For example, CITIC developed a flowsheet which used heat to “calcine” a MgCl2 brine containing LiCl, removing the water and converting the MgCl2 and LiCl to MgO and LiOH when washed with water, with HCl as a byproduct. This is an extremely creative “brute force” technique to separate Li and Mg, though it unsurprisingly turned out to be too expensive and the HCl vapors were an environmental hazard. Whether it was a good idea or not, this kind of creative experimentation could produce significant innovation in lithium processing that people in other countries with more rigid approaches to project development with less access to cheap capital might not be able to cultivate themselves. This is a significant advantage for technology and project development within China.

The experiences of DLE technology and project development from Catamarca to Qinghai demonstrate that DLE technologies cannot be “copy and pasted” between resources, which is also true for the evaporation pond process of the Atacama applied to lower grade, less pure brines. DLE technology selection should always be project-driven. There is no such thing as a “best” technology. Though similar technologies may produce lithium economically from similar resources. Bolivia’s high Mg brine at the Salar de Uyuni (Mg/Li ~ 20), object of fascination of lithium industry speculators for decades, is a high Mg brine. Could DLE unlock that resource too?

Permission has been explicitly granted to publish all of the information presented in this article including production values and photos.

The Fénix Project

Owner: Minera del Altiplano S.A. (Livent Corporation)

Location: Catamarca, Argentina

Commissioning: 1998

Capacity: Near 20,000 tonnes of Li2CO3 equivalent per year as of 2020

Livent’s adsorbent was developed in-house in the 1990s based on intellectual property adapted from Dow Chemical. Their sorbent is used to extract LiCl from brine which has been slightly pre-concentrated using small evaporation ponds. These ponds do not produce potash at meaningful scales like SQM’s ponds in the Salar de Atacama, and are not fundamentally necessary. Different evaporation ponds are used to remove water from the lithium concentrate produced by the DLE process (note: this solution is different from the brine) before the lithium is shipped to Livent’s chemical plant at lower elevation for conversion into other lithium chemicals.

Li2CO3 and LiCl is shipped to North Carolina for processing into LiOH٠H2O, lithium metal, butyllithium, and other specialty lithium salts. (2) Livent is one of the world’s highest quality suppliers of LiOH٠H2O partly because their operation is less subject to weather than in Argentina, which is typically rainier than the Atacama. For over two decades, Livent has been a leader in “the technology behind the technology”, and it will be interesting to see how they use this reputation to expand their operations at Hombre Muerto and into other resources.

The Lanke Lithium Project

Owner: Lanke Lithium (Qinghai Salt Lake Industry Co. Ltd.)

Location: Qinghai, China

Commissioning: 2017

Capacity: Approximately 15,000 tonnes of Li2CO3 per year as of 2020

Qinghai Salt Lake Industry Co. Ltd (QSLI) is the largest and most well-known lithium project in Qinghai. QSLI began their technology development program by trying to adapt an American company’s technology, but they were never able to achieve high lithium recovery and produce high purity products. QSLI ended up collaborating on DLE with a Russian company, and in 2017 they started producing lithium chemicals.

In 2018, they intended to produce upwards of 50,000 tonnes/year by 2020 as part of a consortium with battery manufacturer BYD. (3) In 2018, many in the lithium industry thought that QSLI would flood the market with cheap lithium chemicals, but like many failed projects in development of all resource types, the output never materialized. Despite not reaching Atacama-scale production, the Lanke project and other DLE projects in Qinghai were thought to partially “drive spot prices” in 2019. (4) Though their production was reportedly resilient in the face of heavy rains which caused massive floods in 2018 (as one would expect for DLE), (5) QSLI had to file for bankruptcy in January, 2020. (6) Their bankruptcy was caused by a troubled magnesium metal project despite their lithium product being profitable.

The Zangge Lithium Carbonate Project

Owner: Zangge Potash Fertilizer Co. Ltd.

Location: Qinghai, China

Commissioning: 2018

Capacity: Currently 3,000 tonnes of Li2CO3 per year, ramping up to 10,000 tonnes/year by the end of 2020, and intended to reach 20,000 tonnes/year in the future

An adsorbent is used to extract lithium chloride from Zangge’s saturated magnesium brine. The plant was supposed to ramp up to 10,000 tonnes/year of LCE production by the end of 2019, but there were issues in construction of the plant, including an undersized hot water supply line. It is reported that the Li2CO3 produced by the plant is battery grade (>99.6% pure) and that it has passed qualification evaluations. The timeline of this project’s development was rapid. Zangge announced they intended to produce lithium in September, 2017. In January, 2018 a contract was signed for technology provision and EPC, and the facility began operating in the first half of 2019.(7)

Though new chemical production operations can face delays for a variety of reasons, Zangge’s slow ramp up highlights a risk that DLE project developers should appreciate. In theory, positive cash flows may begin for DLE projects sooner than evaporation pond projects in the South American context since less time is required to evaporate water from the brine during commissioning. But if the project encounters issues in scale-up or the balance of an existing plant is not ready to accommodate the DLE process, the proposed advantage for DLE to produce lithium faster than evaporation ponds is moot.

The Jintai Lithium Carbonate Project

Owner: Qinghai Jintai Potash Co. Ltd.

Location: Qinghai, China

Commissioning: 2019

Capacity: Currently 3,000 tonnes of Li2CO3 per year, with plans to expand to 7,000 tonnes/year by the end of 2020

An adsorbent is used to extract lithium chloride from Jintai’s saturated magnesium brine, similar to the Zangge lithium project. Ramping up the Jintai Lithium Project has been slowed down by the Covid-19 outbreak of late 2019, and other issues with logistics and bad winter weather. (8)

“Acts of God” like pandemics are certainly not issues with a technology or project, and have impacted lithium projects in development and operation in Argentina, which declared a strict Covid-19 lockdown similar to China. Bad winter weather has impacted operations in Argentina before, and a major advantage of DLE is that it can be used in places without the aridity of the Atacama.

The Minmetals Yi Li Ping Salt Lake Project

Owner: China Minmetals Corp.

Location: Qinghai, China

Commissioning: 2020

Capacity: Currently 10,000 tonnes of Li2CO3 per year, currently commissioning a DLE expansion of 1,000 tonnes/year which could grow further

Using a hybrid evaporation & membrane-type process to separate LiCl and MgCl2, Minmetals currently produces 10,000 tonnes/year of Li2CO3 from their Yi Li Ping Salt Lake operation. The process is inefficient and requires a significant amount of water though, so they are expanding output using an adsorbent. Minmetals has recently finished construction of a 1,000 tonne/year unit, which may represent a demonstration facility for their further expansion. Concentrated brine is fed to the DLE facility, with lithium grades already in the 2,000-3,000 mg/L range after an evaporative process.

All of the projects described in this research article currently include brine evaporative processing in their production flowsheets. This is interesting to consider since most technology developers claim that they can remove the need for evaporative processing. It is true that many types of DLE do not require ultra-concentrated brine to function properly (e.g. >2gLi/L). But when brine is not concentrated, it means that much larger volumes need to be processed, and the spent brine needs to be put somewhere. It is not a surprise, when framed this way, that technology and new project developers have targeted more concentrated brines for their first DLE projects. However, by no means must past be prophecy for DLE technology deployment. With DLE deployment accelerating at new projects around the world, true greenfield DLE projects with no brine evaporation will soon be built.

Acknowledgements

Thank you to Yuan Gao, Gary Zhang, Joe Lowry, Albert Li, and Emily Hersh for their perspectives that shaped this article.

References

(1) Song Jianfeng, Chinese Academy of Sciences. Lithium Extraction from Chinese Salt-Lake Brines: Opportunities, Challenges, and Future Outlook. URL.

(2) Livent, Sustainability Report October 2018. URL.

(3) Albert Li, Benchmark Mineral Intelligence. China’s Qinghai Targets Mammoth Lithium Carbonate Expansion – Benchmark Mineral to Visit. URL.

(4) Jingwen Sun, Minmetals Securities Research. China and Its Lithium Supply and Demand Dynamics (Santiago, Chile 2019). URL.

(5) Charlotte Radford Carrie Shi, Fastmarkets. Global Lithium Wrap 31 August 2018. URL.

(6) Yujing Liu, South China Morning Post. Qinghai Salt, China’s largest potash maker, is set to post country’s biggest ever annual loss of US$6.8 billion. URL.

(7) Zangge Potash Fertilizer Co. Ltd. Public Reports.

(8) Qinghai Jintai Potash Co. Ltd. Public Reports.